Latest Security Alerts

Stay Vigilant: Recent Scams Involving Fake Staff Members from another Insurer

Date: March 9, 2025

We wish to alert you to a recent surge in scams involving impersonation of insurance companies and regulatory authorities. These scams have resulted in significant financial losses for many individuals. We urge you to read the following information carefully to protect yourself from falling victim to these fraudulent activities.

Common Scam Techniques

- Impersonation of Officials:

- Scammers pose as representatives from a local insurance company and the Monetary Authority of Singapore (MAS).

- They may contact you via phone calls, video calls, emails, or messaging apps, claiming you have outstanding insurance premiums or policies that need urgent attention.

- Urgent Payment Requests:

- You may be told that you need to pay fees to renew or cancel an insurance policy.

- Scammers often create a sense of urgency, insisting that immediate action is required to avoid automatic deductions of the fee from your bank account.

- Remote Access and Information Harvesting:

- Scammers may ask you to share personal and banking information or to perform actions such as logging into your bank account while they guide you through the process.

- They might use screen-sharing functions or video calls to appear more legitimate.

- False Claims of Fraudulent Activity:

- You may be informed that your bank account is linked to illegal activities or that your personal information has been compromised.

- Scammers will then instruct you to transfer money to a specified account to "verify" or "secure" your funds.

PROTECT YOURSELF.

To help you stay protected, please follow these important precautions:

- Do Not Share Your Banking Details: Never share any of your banking details like UserID or Passwords with a third party, either over the phone or over a video. Prudential and our representatives will never ask you for these details.

- Payment Links: Prudential will never send you a link to make a payment. Customers should visit our website and click on Online Payment or make payment via AXS or internet banking.

- Cash Collection: Our Financial Representatives will also never ask you to transfer any money to them or pay them cash. If you encounter this, please report it to us immediately.

- Phone Numbers and Website Addresses: Be cautious of the phone numbers and website addresses you interact with. Always ensure they are legitimate.

You can click on the lock button in the address bar to verify that the Certificate is still valid (checking the Issuer, validity period etc.)

Prudential Singapore Website Address: prudential.com.sg

PRUaccess (Customer Portal) Website Address: pruaccess.prudential.com.sg/pruaccess_sg/login.jsp

iPay Website Address for Premium Payment: ipay.prudential.com.sg/ipay/login2.do

Report Suspicious Activity: If you receive any suspicious calls or messages, report them immediately to the relevant authorities. If the suspicious SMS or calls seems to originate from Prudential or if you come across any websites that are trying to spoof Prudential websites, please do not hesitate to contact your Financial Consultant or call us at PRUCustomer Line at 1800-333-0-333.

Other Contacts

- MAS ScamShield Helpline: 1799

- ScamShield Website: www.scamshield.gov.sg

Stay vigilant and protect yourself from scams. If you have any questions or need further assistance, please do not hesitate to contact us.

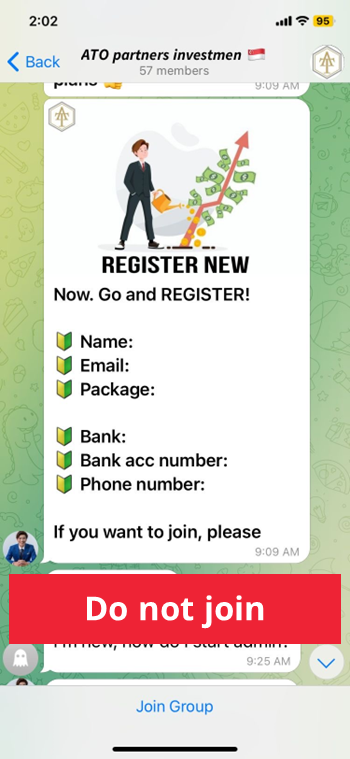

Scam Alert: Beware of Fraudulent Telegram Group

Date: 25 November 2024

We have been informed by a member of the public about a fraudulent Telegram group named "ATO Partners investmen" that is soliciting funds by promising lucrative returns within 2 to 3 hours. The group administrator listed on the profile is impersonating a Prudential Financial Representative, using profile pictures taken from his social media account. A police report has been lodged regarding this matter.

We urge everyone to be vigilant against such fraudulent schemes that promise high-paying returns without providing a proper explanation of the investment or sharing legitimate investment documents. When in doubt, always verify by contacting us.

Let us stay alert to such fraudulent schemes.

Removal of Clickable Links for Reward Notifications

Date: 5 February 2024

At Prudential, we take active steps to protect our customers against potential scam attempts.

Starting 16 February 2024, we will no longer include a clickable link in our SMS or email to customers who are eligible for a reward or e-voucher.

Customers who are eligible to receive rewards vouchers and receive a notification to make a redemption can visit our official website and look for “Rewards” in the website header or dropdown menu (for those viewing on mobile) to log in to our rewards portal.

Eligible customers will find further instructions in their reward notifications.

For customers who are eligible for Opus Rewards, please refer to the redemption guide here.

For all other customers, please refer to this redemption guide.

Insurance Payout Scam

Date: 16 August 2023

We have been notified of a recent scam attempt where an individual (“A”) borrowed money from someone (the victim) by misleading the victim into believing that A is the beneficiary of several insurance policies and will be repaying the loan using the payout from these policies.

In this case, A met a female individual on a dating app, who later claimed to be bankrupt and in need of money. She requested for a loan and as an assurance that she will be able to repay A, she misled A to believe she is the beneficiary of two Prudential insurance policies using forged documents which stated she will be receiving payouts from the policies soon. The victim transferred several sums of money to the female individual.

Soon after, A contacted Prudential to verify the validity of the insurance policy document he had received, and upon verification by our service staff, it was found that the policy documents he received were forged. He proceeded to lodge a police report immediately.

We would like to remind our customers to remain vigilant at all times: Protect your banking and insurance accounts by not sharing your log-in details with others, and not performing financial transactions on anyone else’s behalf. You should also not transfer money to others until you have you been able to verify the legitimacy of their requests.

Should you encounter any suspicious activities, please do not hesitate to contact your Financial Consultant or call us at PRUCustomer Line at 1800-333-0-333.

Impersonation of Prudential Financial Consultant

Date: 3 March 2023

We have been notified of an impersonation attempt where a customer received a call from someone impersonating as his financial consultant. The impersonator (a female) informed the customer that she had recently updated her mobile number and requested for the customer to “update her mobile number”. The impersonator continued contacting the customer, pretending to recommend financial plans before eventually requesting for his One-Time-Password (OTP) without any reason. Thankfully, this customer was alert and did not divulge his OTP. It is important to safeguard your passwords and OTP to prevent unauthorised use of your PRUaccess account.

Should you receive any suspicious calls from Prudential, please do not hesitate to contact your Financial Consultant or call us at PRUCustomer Line at 1800-333-0-333.

Anti-SMS Scam and Official Sender ID

Date: 1 February 2023

To protect the public against SMS Scam attempts, the Infocomm Media Development Authority (IMDA) now requires organisations to register their SMS Sender IDs with the Singapore SMS Sender ID Registry (“SSIR”), so that only bona fide organisations can use such Sender IDs.

Prudential has registered the following SMS Sender IDs with the SSIR and beginning 1 February 2023, customers receiving SMSes from the following Sender IDs can be assured that they are sent from us:

- Prudential

- PulsebyPRU

- 91841620 (for 2-way SMS)

- 98275442 (for 2-way SMS)

To find out more about the Anti-SMS Scam measures introduced by IMDA, please click here.

Should you receive any suspicious SMS from Prudential or come across any websites that are trying to spoof Prudential websites, please do not hesitate to contact your Financial Consultant or call us at PRUCustomer Line at 1800-333-0-333.

Beware of Scam Attempts via SMS

Date: 20 October 2022

An update on SMS Spoofing. Scammers continue to find ways to target consumers, sending SMS or email communications that look legitimate but contained links to fake or spoof websites. These websites may look similar to the original websites in an attempt to phish customer’s login IDs, passwords and OTP (one-time-pin).

We would like to advise customers to be careful whenever clicking on a hyperlink, whether in an SMS, email, social media message or social media post. Always check the authenticity of the website before entering any login details or personal details.

How to check the authenticity and security of a website

-

You can verify if the website address is accurate by inspecting the address. Scammers may try to mimic our websites and use fake URLs such as “prudentail.com.sg” or “prudentia1.com.sg”

Important: Before clicking on a link, do check the URL. Our official websites contain “prudential.com.sg” or “pru.sg” while Rewards SMSes will contain a link to “pru-promo.dgx”. -

You can click on the lock button in the address bar to verify that the Certificate is still valid (checking the Issuer, validity period etc)

- Prudential Singapore Website Address: prudential.com.sg

- PRUAccess (Customer Portal) Website Address: pruaccess.prudential.com.sg/pruaccess_sg/login.jsp

- iPay Website Address for Premium Payment: ipay.prudential.com.sg/ipay/login2.do

Should you receive any suspicious SMS from Prudential or come across any websites that are trying to spoof Prudential websites, please do not hesitate to contact your Financial Consultant or call us at PRUCustomer Line at 1800-333-0-333.

Scam Attempts via SMS

Date: 28 January 2022

Recently, there have been successful fraud attempts involving SMS Spoofing, where scammers targeted bank customers, sending them SMSes that looked legitimate but contained links to fake or spoof websites. These websites may look similar to the original websites in an attempt to phish customer’s login IDs, passwords and OTP (one-time-pin).

We would like to advise customers to be careful whenever clicking on a hyperlink, whether in an SMS, email, social media message or social media post. Always check the authenticity of the website before entering any login details or personal details.

Fraudulent SMS From “Prudential Finance”

Date: 2 February 2021

We have been notified of an SMS Scam where an unknown third party had sent SMSes using the name ‘Prudential Finance’ and offered unsecured loans. This incident happened on 24 December 2020.

We wish to clarify that Prudential is not related to ‘Prudential Finance’ and we do not issue any unsecured loans and customers who received the SMS are advised to ignore it and not contact the numbers listed.

Should you receive any suspicious SMS from Prudential in the future, please do not hesitate to contact your Financial Consultant or call us at PRUCustomer Line at 1800-333-0-333.

Helpful Information

WHAT ARE LOAN SCAMS?

SMSes or WhatsApp messages that are sent by scammers disguised as licensed banks / financial providers offering loan services to random users. As part of these scams, scammers may ask for users personal information like Singpass details, NRIC, bank account numbers and mobile numbers. Interested parties are then told to transfer money as a deposit before the loan can be disbursed to them. After making the transfer, users find that the scammers are no longer contactable and end up being victims to these loan scams.

Avoid responding to or contacting the numbers in such SMSes.