Rewarding you for staying healthyWe know the benefits of a healthy lifestyle. Your efforts in healthy living will be rewarded, not just with good health, but also with savings on your premiums through a claims-based premium pricing approach. What is claims-based premium pricing?Claims-based premium pricing is a fairer pricing approach for our policyholders to save on premiums without compromising on medical care. It is applicable for PRUExtra Premier CoPay, PRUExtra Preferred CoPay, PRUExtra Premier#, and PRUExtra Plus# customers only. How does it work?With claims-based premium pricing, you will start off at the Standard Level Premium, the lowest premium level of your age band. You also enjoy the PRUWell Reward, a percentage discount on your Standard Level Premium when your policy is incepted with no special terms and conditions. Each year, your premium level will be determined by any previous claims you made during the review period. As long as you stay healthy, with no claims made on your supplementary plan, you will continue to enjoy the PRUWell Reward on your Standard Level Premium at your next policy renewal. Claims-based premium pricing for our private supplementary plans - PRUExtra Premier CoPay, PRUExtra Preferred CoPay, and PRUExtra Premier#Our unique claims-based premium pricing mechanism rewards our customers for staying healthy and modest usage of healthcare services

When you’re in a pink of health and did not make any claims on your PRUExtra plan, you’ll enjoy 20% off your Standard Level premiums at your next renewal. And your premiums will either remain at Standard Level Premiums, or move down 1 level if you are at a level higher than the Standard Level Premiums By choosing specialists empanelled at private hospitals under PRUPanel Connect, you can maintain your premium level* without an increase of 2 or 4 levels. After your PRUShield claim is paid, if you manage to recover a minimum of S$1,000 by claiming for the medical treatment from other policies, such as your corporate insurance plan, your premiums will either remain at Standard Level Premiums or move down 1 level if you are at a level higher than the Standard Level Premiums. This is an alternative to keep your personal insurance premiums affordable. For more information on how to recover cost of your medical claims from third party, visit www.prudential.com.sg/prushieldclaims

~Based on age next birthday, at policy renewal PRUExtra Premier CoPay and PRUExtra Premier

Note: All private hospital claims paid during the same review period will be added together to calculate the total claim payment amount under your PRUExtra Premier CoPay or PRUExtra Premier plan. If there is a claim from a private hospital or private medical institution that is not under our panel providers or is under EP specialists (not at our Panel HI), and it is paid within the same review period as a panel provider or an EP specialist (Panel HI) claim, the claim-based premium level will be based on the private hospital or private medical institution that is not under our panel providers’ or is under EP specialists’ (not at our Panel HI) premium level (see table above). Any restructured hospital claim paid during the same review period will not be added together to calculate the premium level. PRUExtra Preferred CoPay

Note: All private hospital claims paid during the same review period will be added together to calculate the total claim payment amount under your PRUExtra Preferred CoPay plan. If there is a private non-panel provider or an EP specialist (Non-panel HI) claim paid within the same review period as a panel provider or an EP specialist (Panel HI), the claim-based premium level will be based on the private non-panel provider’s or EP specialist’s (Non-panel HI) premium level (see table above). Any restructured hospital claim paid during the same review period will not be added together to calculate the premium level. * The claim-based premium level of PRUExtra Premier CoPay, PRUExtra Preferred CoPay, and PRUExtra Premier# will remain on the same level provided all private hospital claims paid during the same review period are under our panel providers. Non-panel ProviderNon-panel providers refer to:

We may change this panel or non-panel list from time to time. For the updated list of participating panel providers, please visit PRUPanel Connect on our website. No Access Healthcare Institutions (No Access HI)All private hospitals or private medical institutions not under our panel or non-panel list will be considered as “No Access”. If your PRUExtra plan is PRUExtra Preferred CoPay, any claim you make for expenses incurred at hospitals or medical institutions considered as No Access, will not be reimbursed under the PRUExtra Preferred CoPay plan, except in the event that the life assured requires inpatient hospital treatment as a result of Emergency Medical Treatment while overseas. The No Access list is not applicable for the other PRUExtra plans. Extended Panel (EP) SpecialistAn Extended Panel specialist is a registered medical practitioner who

EP specialist (Panel HI) refers to an EP specialist where hospitalisation, surgery and/or treatments are carried out at our Panel HI. EP specialist (Non-panel HI) refers to an EP specialist where hospitalisation, surgery and/or treatments are carried out at our Non-panel HI. EP specialist (No Access HI) refers to an EP specialist where hospitalisation, surgery and/or treatments are carried out at our No Access HI. Note: Eligibility for EP benefits – If there is no PRUextra attached to the main claim, stop loss will not be applicable. Learn more about the Extended Panel. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

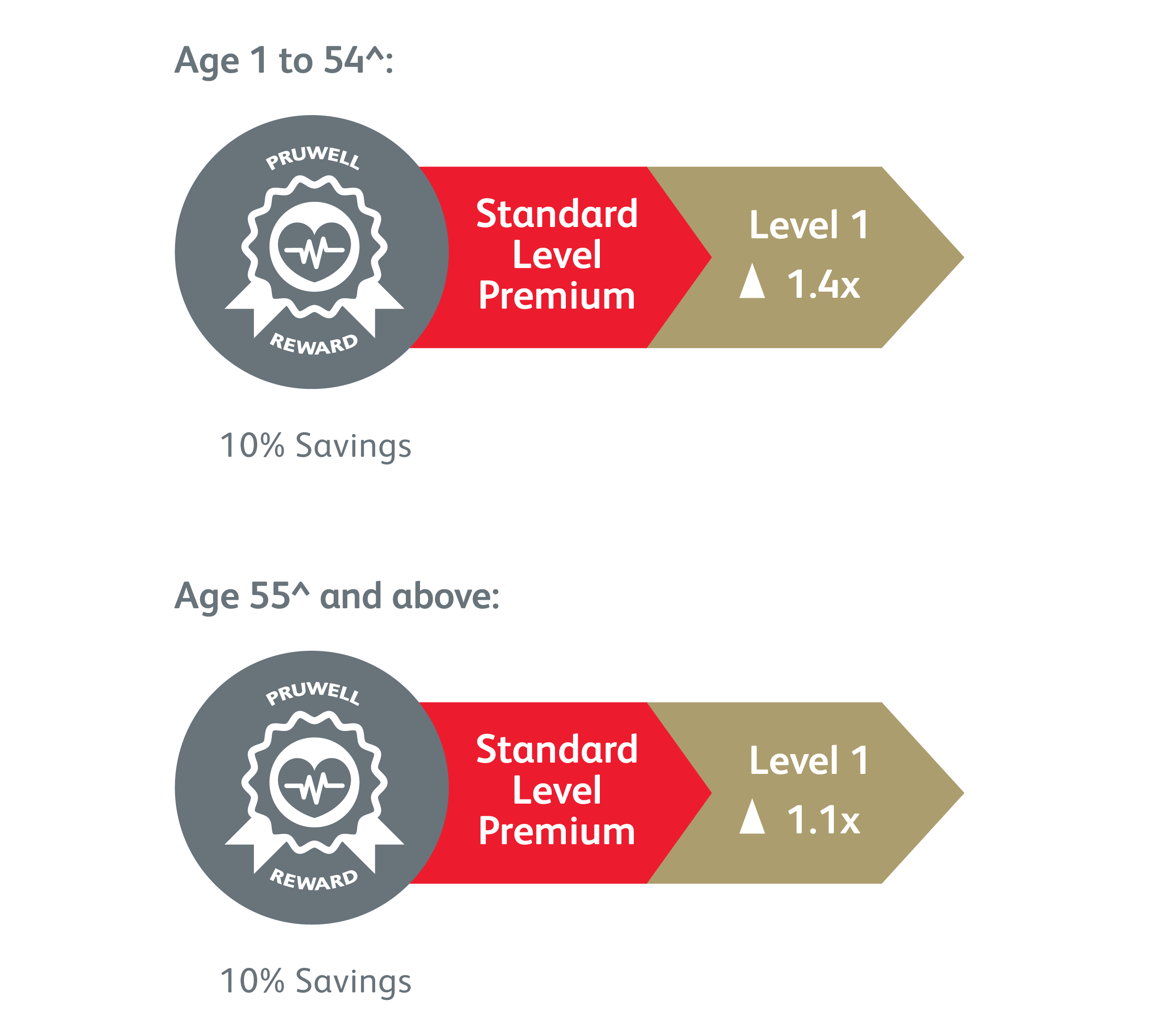

Claims-based premium pricing for our public supplementary plan - PRUExtra Plus#

Our unique claims-based premium pricing mechanism rewards our customers for staying healthy and modest usage of healthcare services:

-

Enjoy Premium Discounts with PRUWell Reward

-

Seek treatment at Panel Providers

-

Claim from Other Insurance Plans

When you’re in a pink of health and did not make any claims on your PRUExtra plan , you’ll enjoy 10% off your Standard Level premiums at your next renewal.

Your premiums will either remain at Standard Level Premiums, or move down 1 level if you are at a level higher than the Standard Level Premiums and your restructured hospital claim is S$20,000 and below.

By choosing specialists empanelled at private hospital under PRUPanel Connect, you can maintain your premium level without any increase, if all claims within the same review period is successful panel claim.

Please note that pro-ration will apply for medical expenses incurred from private panel hospital.

After your PRUShield claim is paid, if you manage to recover a min of S$1,000 by claiming for the medical treatment from other policies, such as your corporate insurance plan, your premiums will either remain at Standard Level Premiums or move down 1 level if you are at a level higher than the Standard Level Premiums. This is an alternative to keep your personal insurance premiums affordable.

For more information on how to recover cost of your medical claims from third party, visit www.prudential.com.sg/prushieldclaims

^Based on age next birthday, at policy renewal

| Source of Claim |

Claim payment from PRUExtra plan during the Review Period |

Premium level (at the next policy renewal) |

|

| Panel providers (except Singapore restructured hospitals or treatment centres) | Any amount | Remains on the same level | |

| Not under panel providers | S$5,000 and below | Remains on the same level | |

| Above S$5,000 | ↑ 1 Level (limit at Level 1) | ||

| Singapore restructured hospitals or treatment centres | S$20,000 and below | ↓ 1 Level (limit at Standard) | |

| Above S$20,000 | Remains on the same level | ||

| No claim | NA | ↓ 1 Level (limit at Standard) | |

Note:

All private Hospital claims paid during the same review period will be added together to calculate the total private hospital claim payment amount under your PRUExtra Plus plan. The claim-based premium level will remain on the same level provided all private hospital claims paid during the same review period are under our panel providers. While all restructured hospital claims paid during the same review period will be added together to calculate the total restructured hospital claim payment amount under your PRUExtra Plus plan.

If there is a restructured hospital claim paid within the same review period as a private hospital claim, the final premium level will be based on the premium level of the restructured hospital or the private hospital, whichever is higher.

#PRUExtra Premier and PRUExtra Plus are no longer available for new business, mid-term add and upgrades with effect from 1 April 2019

Panel Providers

Our Panel Providers consist of participating specialists on the PRUPanel Connect programme who provide inpatient or day surgery treatment at Panel Healthcare Institutions.

Panel Healthcare Institutions (Panel HI) refer to:

-

all restructured hospitals and treatment centres

-

participating private hospitals; and

-

participating private treatment centres,

that appear on PRUPanel Connect on our website

Participating specialists refer to registered medical practitioners and Specialists that appear on PRUPanel Connect on our website.

Find out more

Please refer to the customer portal PRUaccess for the revised premiums based on your age band.

For more information contact your Financial Representative or call our PRUCustomer Line on 1800 333 0333 (Monday – Friday, 8.30am – 5.30pm).

Note: Terms and conditions apply. PRUExtra premiums cannot be paid using MediSave. You are recommended to read the product summary and seek advice from a qualified Prudential Financial Representative for a financial analysis before purchasing a policy suitable to meet your needs. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. Premiums are not guaranteed and may be adjusted based on future claims experience. Prudential reserves the right to vary premiums at any time by giving 30 days’ written notice to the policyowner before doing so. The information on this website is for reference only and is not a contract of insurance. Please refer to the exact terms and conditions, specific details and exclusions applicable to these insurance products in the policy documents that can be obtained from your Prudential Financial Representative. The information contained on this website is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

In the event that the policy is not suitable, the client may cancel the policy by making a written request to Prudential within the 21-day free look period. Prudential will refund any premiums paid, less medical fees, other expenses incurred and any outstanding amounts owed in connection with the policy.

Information is correct as at 1 May 2025.